10 Tips for Managing Finances, Student Loans, and more!

January 10, 2019 Volunteer

“Improving my finances” has to be one of the most common New Year’s resolutions year after year, and for a good reason! When you have a good understanding of how to manage your finances, you set yourself up for a more stable future.

However, according to a study in the Journal of Clinical Psychology, only 46% of people who make New Year’s resolutions actually keep them. That’s when we step in!

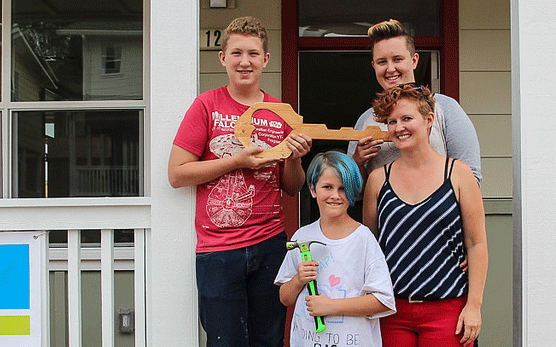

At Habitat, we know that having healthy finances is vital to open doors to opportunity. So, our Housing Counseling Program is here to help kick off the New Year with our top 10 tips to better manage your finances and achieve your New Year’s resolution!

1. Keep balances low on your credit cards. The closer your credit card balance gets to your high credit limit, the lower your credit score will be.

2. If you pay off a credit card balance, don’t close the account. Leave the account open – just don’t use it. Closing the account will hurt your credit more than helping it.

3. You can get a free copy of your credit report at www.annualcreditreport.com. Monitor your credit throughout the year for free. You are entitled to a free copy of your credit report from each of the three major credit reporting agencies (shown in the link) every 12 months. If you request your free copy from one credit reporting agency, then wait four months and request your free copy from another credit reporting agency. Rotate your requests every four months (Equifax, then TransUnion, then Experian, and then back to Equifax), and you can get a copy for free every four months.

4. Everyone should have an emergency fund to prepare for the unexpected. You never know when you might experience a major car repair, loss of a job, illness or injury, etc. You should have the equivalent of between three and six months of your take-home pay in

5. Develop a household budget. This will help you determine how much you can save each month. Calculate all income (

6. Identify ways to reduce expenses if your budget doesn’t balance or you’re trying to reach a specific financial goal (buying a car or a home, paying off credit cards, financing an education, etc.).

7. If you’re struggling to pay student loans...check out the various loan repayment options for federal student loans such as income-based repayment or loan forgiveness if you work in a public service position. Information is available

8. Set specific financial goals for yourself – whether it’s paying off debt, purchasing a car or a home, taking a vacation, etc. By putting money in a savings account each month, you can reach your goals and avoid costly debt. Your budget can help you determine how much you need to save each month and how long it will take you to reach the goal.

9. Pay yourself first. Once you have determined how much money you can save each month toward your financial goal, pay yourself first. If you wait until the end of the month, often that money is no longer there – but has been spent on other temptations.

10. If you need help, ASK! If you need help managing monthly expenses, want help putting together a budget to reach a goal, or need help understanding how to improve your credit, contact a non-profit Housing Counseling Agency. Habitat for Humanity East Bay/Silicon Valley is a HUD-certified Housing Counseling Agency. It’s free!

Join the Conversation

Leave Us a Comment!

We love hearing from our community. Let us know what you think by leaving us a comment below.