5 Ways to Stick to A Budget

February 25, 2021 Housing Counseling

When you learn how to budget, you learn how to how to make smart choices that save your money rather than overspend it. Sticking to a budget helps you take more control of your finances, so that when you think of your financial health, you feel confidence instead of dread.

However, we know the idea of budgeting can be intimidating, so Habitat’s Housing and Financial Counseling Program is sharing our top 5 tips to help you stick to a budget.

Read on below for some good guiding principles to help you get in better financial shape!

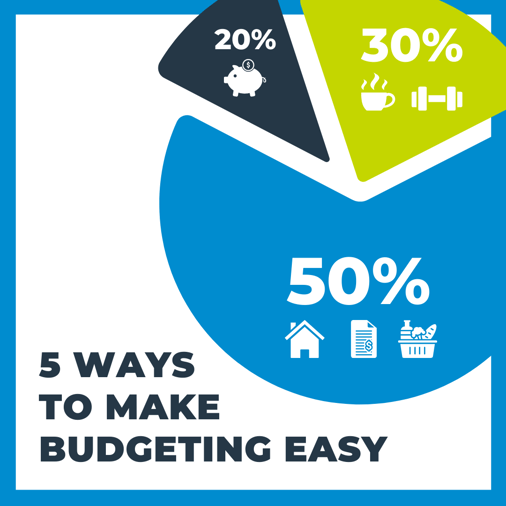

- Think 50, 30, 20. A 50-30-20 budget offers a general guideline for allocating your monthly take-home income. Limit your “need” expenses to 50%. Needs are expenses you cannot do without – like housing, food, and transportation costs for work. Try to keep your “want” expenses to 30%. Wants are expenses that enhance your lifestyle but are not necessary to live – like eating out, entertainment, and gym memberships. For that last 20%, think forward. At least half that (10% of your income) should go toward savings. The rest, you can put toward paying credit card and loan debts.

- Keep your eye on your rules. Set savings and budgeting rules to live by. Write them down and keep them where you can see them. Maybe it’s a note on your bathroom mirror: “I will save $10 per week.” Or stickie on your computer monitor: “I’m putting away $100 this month!” Perhaps a reminder that pops up on your phone every Friday: “I will track my expenses at the end of each week.” Whatever the rule or the habit, these notes can serve as reminders and motivators to keep you on target for better financial health.

- Credit cards aren’t for every day. Think of using a credit card as borrowing money – not as a form of payment. When you pay for something with a credit card, it’s like borrowing money from a friend – one you’ll need to pay back with interest. So, try to avoid using your credit cards for everyday expenses, which can be a fast track to debt. Instead, aim to save your credit card for emergencies and to preserve your credit history.

- Follow the 24-hour rule. In order to keep impulse buying under control, give yourself a day to mull these purchases over. Do this with the 24-hour rule. When you’re considering an impulse buy, don’t hit that purchase button or put it on the conveyer belt right away. Instead, give yourself at least 24 hours to think about whether the purchase is worth your hard-earned money!

- Try the envelope system. Budgeting does not mean eliminating all “want” expenses, but it does mean making conscious decisions about this spending. To help you stick to your budget for “wants,” we recommend the envelope system. Set aside the amount you’ve budgeted for an activity in cash, and stick it in an envelope. Once that money runs out for the month, it’s time to hit pause on that activity until next month. For instance, love to order in? Allocate a certain amount of cash to spend on takeout for the month, and put that money in an envelope. Dip into that fund whenever you enjoy a restaurant meal at home – but once you’ve exhausted that cash, it’s time to get back into the kitchen until next month!

Looking for help putting these ideas into practice?

Schedule a one-on-one appointment with a Habitat Housing Counselor and, together, we’ll create a plan tailored to you and your family’s needs! Also, the Consumer Financial Protection Bureau (CFPB) has a bill calendar tool that can help you track your bills and plan ahead. With all these resources at your fingertips, we know you can set yourself up for a great year ahead.

Join the Conversation

Leave Us a Comment!

We love hearing from our community. Let us know what you think by leaving us a comment below.