Tips for First-Time Homebuyers

June 1, 2023 Homeownership Housing Counseling

Purchasing your first home can be one of the most expensive investments you’ll ever make. So, how do you know if becoming a first-time homebuyer is right for you? How do you choose a loan? What will your closing costs be? How do you get a first-time mortgage? What is a mortgage? Can you even purchase a home in the Bay Area?

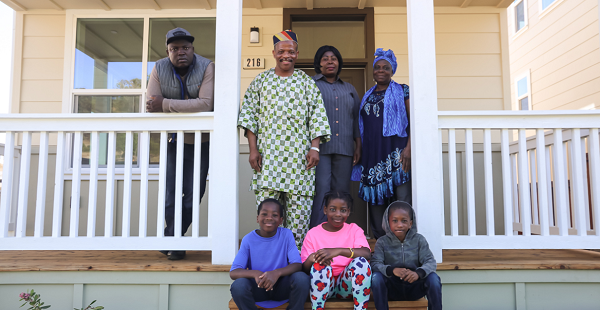

Head spinning over the idea of becoming a homeowner? Habitat for Humanity’s Housing and Financial Counseling Program is here to help with some tips for first-time homebuyers in the Bay Area.

First, it is important to understand the difference between renting and owning a home, and ask yourself, “Is homeownership right for me?” Everyone’s situation is different, and while homeownership can be an important investment, it is not right for everyone.

What should first-time homebuyers consider when deciding between purchasing a home or continuing to rent?

Here are some perks of homeownership, along with some things to consider in your decision:

- Stability:

Unlike renting, owning your own home makes you your own landlord. Without the fear of eviction or rent increases, you and your family can plant roots in your community.  Flexibility:

Flexibility:

Depending on your lease agreement, renters often have more flexibility to move when they want. Think of it this way. When you own your home, and you need to move, you’re still on the hook for all your payments until you sell it! Before you can move and be free from all the costs associated with the home, you need to go through the process of selling it. Until that home sale is complete, you’ll still be obligated to cover the cost of owning your home – which means that money isn’t freed up to pay rent on a new place. Also, it means you’re still in mortgage debt until you sell that house, so it may be tough to qualify for rent in a new place.- Stable Housing Costs:

Most homeowners have a fixed-rate mortgage, which is a home loan with a consistent interest rate. This means that your mortgage payment is the same for the life of the loan, making it easier to plan and save for future financial decisions and expenses. Bear in mind that while that mortgage payment won’t change, you might still have some homeowner expenses that do change over the years, like property taxes, homeowner insurance, and homeowner association dues. However, while those variable expenses might increase, they don’t usually increase as much – or as often – as rent does. - Equity Building:

When you purchase a home, you grow home equity. What is home equity? Home equity is the difference between your home’s market value and what you owe on it. Think of it as a piggy bank – you slowly accumulate wealth over a long period of time. How does home equity build wealth? Over time, you’ll make mortgage payments, which brings down the amount you still owe on your home. Meanwhile, the market value of your home can go up. So, the difference between how much you owe – which goes down as you make payments – and your home’s market value – which might go up over time – gets bigger and bigger: that’s equity. Nerdwallet.com explains, “Mortgage payments reduce what you owe while your home gains value, so paying on a house has been called ‘a forced savings account." - Costs:

There are upfront costs to purchasing a home. This is something many first-time homebuyers forget to think about – or worse – forget to plan for. According to our Financial Education Center’s “Considering Homeownership” educational playlist, upfront costs may include:- 0% - 20% of the purchase price for a down payment

- 2% - 5% of the purchase price for closing costs

- $200 - $600 for inspections

Then, you need to think about ongoing costs, which may include:

-

- Mortgage payments

- Property taxes

- Homeowner insurance

- Maintenance and repairs

- Utilities

- Homeowner’s association or condo fees

So, you may be asking yourself, “Can I afford to become a homeowner in the Bay Area?” Consider what you can afford upfront and the value you see a home bringing to your family as you grow. Renting may be a more affordable option at the start, but as the perks of homeownership accumulate over time, owning your home may make more long-term financial sense.

So, you may be asking yourself, “Can I afford to become a homeowner in the Bay Area?” Consider what you can afford upfront and the value you see a home bringing to your family as you grow. Renting may be a more affordable option at the start, but as the perks of homeownership accumulate over time, owning your home may make more long-term financial sense.

See what you can afford using our Financial Education Center’s “Explore the Costs” calculator!

Once you’ve decided you’re ready to purchase a home, you must take the time to prepare for your future house search. And we don’t just mean browsing Zillow for hours. You’ll need to save for upfront costs like your down payment, explore and understand your first-time homebuyer loan options, and research a first-time homebuyer assistance program that’s right for you!

For many people, the first and biggest obstacle to homeownership is a low credit score.

Here are some tips to improve a low credit score:

- Check your credit report for free at www.annualcreditreport.com and make sure it’s accurate.

- Pay down debts to improve your debt-to-income ratio. Start by making on-time payments for all bills and make at least the minimum payments on your debts (but the more you can allocate toward debt payments, the more quickly your credit score may improve over time).

- Create a plan to prevent going further into debt.

- Meet with a Housing Counselor at a HUD-approved Housing Counseling agency to understand your credit score and create a personalized plan to pay off your debt and avoid future debt. To get started, Habitat’s Housing and Financial Counseling Program offers free one-on-one counseling with HUD-certified counselors.

One way to make homeownership more accessible is to enroll in a First-Time Homebuyer Program. You are considered a first-time buyer if you haven’t owned a home in the past three years. First-time buyers can apply for grants and specialized loan programs that provide down payment and closing costs assistance.

Our best advice for first-time homebuyers in the Bay Area:

Bottom line – becoming a homeowner in the Bay Area is tough, but it is possible! Our top tip to help guide you through the competitive and overwhelming homebuying process is to attend a HUD-approved First-Time Homebuyer Class.

Whether required by a First-Time Homebuyer Program or completed on your own, attending this 8-hour class is a great introduction to the homebuying process. Guided by a HUD-certified Housing Counselor, you’ll get more details on where to start, what you can afford, and how to qualify for a home loan or First-Time Homebuyer Program. You’ll get access to tools and resources to help you navigate the homebuying process and an introduction to the following:

- Preparing for homeownership

- Steps of the homebuying process

- Obtaining a mortgage loan

- Shopping for a home

- Protecting your investment

- Managing your money

- Understanding credit

In partnership with eHome America, Habitat’s Housing Counseling program offers an online, Homebuyer Education course, that you can complete at your own pace.

Whether purchasing a home with Habitat or looking for a home on the open market, Habitat’s Housing and Financial Counselors are here to answer any question – big or small – to help you navigate the homebuying process with confidence.

Click here to learn more and contact a Habitat Counselor today.

Join the Conversation

Leave Us a Comment!

We love hearing from our community. Let us know what you think by leaving us a comment below.